The Stamp Duty Holiday Extension Explained

Posted on: Wednesday, March 3, 2021

On 3 March 2021, Chancellor Rishi Sunak announced that the Stamp Duty Land Tax (SDLT) holiday will be extended until 30 June 2021 after facing pressure to extend the deadline by three months amid concerns of a ‘cliff-edge’ come the end of March.

In the 2021 budget, Sunak confirmed that buyers hoping to make the most of the savings of the higher £500,000 nil-rate band will now have until the end of June to complete sales in England and Northern Ireland. From the end of June until the end of September 2021, the nil-rate band will reduce from £500,000 to £250,000.

This comes as a huge relief to homebuyers who were hoping to take advantage of the holiday, yet with the initial deadline looming, were not so optimistic about the transaction completing in time.

The holiday was intended as a stimulus for the property market, and many buyers were encouraged to enter the market as a result. Many homeowners escalated their plans to move in order to make the deadline and benefit from the tax relief. In fact, according to Zoopla, in the last quarter of 2020, there were over 140,000 more people in the process of purchasing a property than there were in the previous year, with an estimated 418,000 home sales progressing to completion.

Iain McKenzie, CEO of The Guild, says: “In the 2021 Budget, the Chancellor gave the property market a double shot in the arm today, with a boost from the Stamp Duty holiday extension and 95% mortgages. Extending the Stamp Duty holiday until the end of June, then phasing it out until September should help avoid a sudden downturn in prices caused by the much-feared cliff-edge end.

“With the zero-rated Stamp Duty limit extended to £250k until the end of September and the average UK house price being £252k, it means that thousands of people can benefit from this incentive - particularly first and second-time buyers. The Government is really looking to turn Generation Rent into Generation Buy.”

SDLT explained

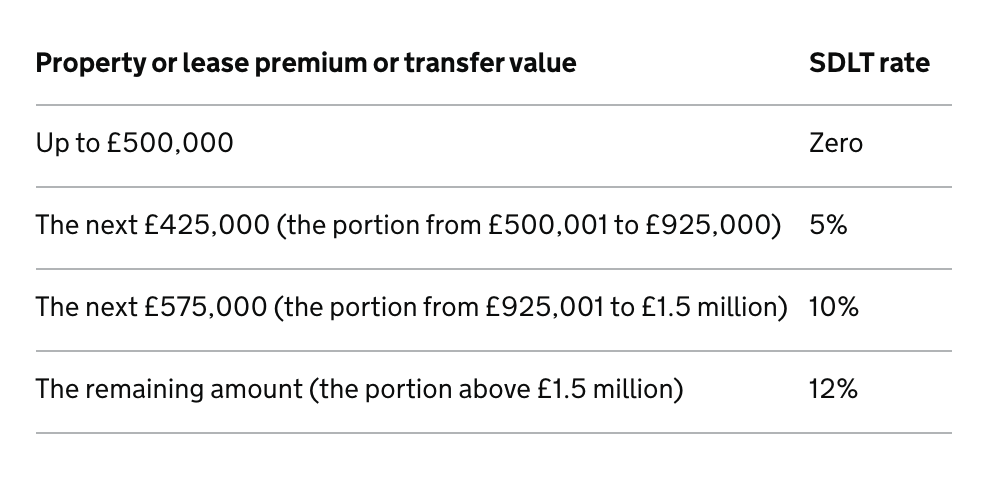

The initial threshold is where SDLT starts to apply. If you purchase a property for under £500,000 before the June deadline, there is no SDLT to pay.

On purchases over the £500,000 threshold, buyers will pay a 5% SDLT on the portion from £500,001 to £925,000, 10% on the portion from £925,001 to £1.5 million, and 12% on any portion over £1.5 million.

Landlords and people buying second homes can also benefit from the holiday, but still continue to pay the 3% Stamp Duty surcharge, which applies to additional properties.

On property purchases from 1 July to 30 September 2021, the SDLT threshold on residential properties will be £250,000. From 1 October, and the SDLT threshold will be £125,000 for residential properties.

Due to a surge in demand for property purchases following the original announcement, many lenders faced a huge backlog of mortgage applications. This led to a large number of buyers being unlikely to make the March deadline. The extension should allow time for buyers to complete their purchases and benefit from the Stamp Duty holiday they had expected to take advantage of when they began their purchase.

First-time buyers

From 1 July 2021, if you, or anyone else you’re buying with, are first-time buyers, or if the purchase price is £500,000 or less, you will get a relief that means you’ll pay less or no tax. You’ll also be eligible for this discount if you bought your first home before 8 July 2020.

Use our Stamp Duty Calculator to work out how much you will have to pay for the property you buy.

Contact us

If the Stamp Duty holiday extension has made you think about selling your home, book a valuation today.

Recent News

Winter 2025 UK Property Market Report: Underlying Resilience

Read More

Regional Property Market Update Winter 2025: Wales

Read More

Regional Property Market Update Winter 2025: Northern Ireland

Read MoreRead What Our

Customers Say